This is the article published by the Argentine-American Chamber of Commerce in Florida. Objective: to show what we consider the most convenient business in real estate in Argentina.

Real Estate

Where to invest in real estate? The Argentina case.

By Mariano Capellino, founder and CEO at INMSA

This is not a novelty. Argentine people have considered real property as one of the safest investments which, in the mid-term, generates money. The “brick”, as we say in Argentina, provides safety and guaranteed profitability.

The crisis experienced in 2001 in the country helped consolidate this belief. For more than 8 years, from 2002 to 2010, there was a Recovery and Expansion Phase of the Cycle, as so called by us, experts in real estate investments worldwide. During the first 4 years, premium real estate -which had dropped 35% on average- experienced a fast recovery and continued to grow during the subsequent four years as investors did not have any other low-risk alternatives available. Furthermore, since 2005, 5 years of recovery and expansion took place but, in this case, involving class B and C assets, where middle-class people live in peripheral areas, first in the city of Buenos Aires and then, in the Metropolitan Area of Buenos Aires and the most important cities in the interior of the country.

Based on this experience, it was assumed that you always make money. And, even though it is very good business to invest in real estate, nothing could be further from reality than the fact that it is always good business.

Large real estate investment funds worldwide build investment portfolios by evaluating and selecting the most convenient market (country, city and neighborhood), the type of asset (residential property, offices, retail, urban lands, etc.) and the class of asset (A, B and C) to invest in. In general, small and medium investors buy always in the same country and, many times, in the same neighborhood. Instead, large funds are willing to move to other markets for one single reason: market cycles.

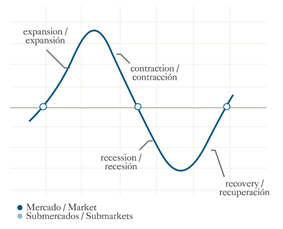

This business is controlled by the cycle of markets as profitability rate, after the recovery and expansion phase of the cycle, will tend to drop or even become negative in the correction and recession phases. It has been proved that it is very difficult that the success reached recently in one market and class of asset, can be repeated in the same way in the near future. The markets have the so-called opportunity window which usually does not exceed five years. It is necessary to enter at the right moment when the value of the property is very low and there is evidence that the recovery phase is being initiated, which normally takes place after an economic or real estate crisis. And exit when the peak price is coming, i.e. at the end of the expansion stage when the appreciation rates start to decline. Many investors are tempted as they think that the property will be revalued at the same pace, but that does not happen.

And that was the situation in Argentina. Some time ago, it was good business to buy a type of asset to subsequently sell it and enter another one and in another location. But most investors did not follow such process. Therefore, what was originally obtained in the recovery process was afterwards mostly lost, as the asset was kept for a long time without important reappraisals and without reasonable rental income – in Argentina, today only a maximum of 2% net amount in US dollars can be obtained annually.

Let´s have a look at numbers: professional sophisticated investors entered Argentina in 2003 and exited in 2008/9, getting 18% profitability in US dollars annually. From 2009, they moved to USA, Miami and other cities, taking advantage of the profound crisis undergone in Miami Beach and Brickell and, after 4 years, they sold and obtained more than 15% in US dollars annually. And they acquired middle-class homes in zones where residents of South Florida live, class B assets, and exited 4 years later in 2017 and 2018 reaching annual income levels higher than 25%. Today, they are investing in other opportunities in other markets such as Detroit or Spain, the current big stars in the real estate business.

This result which enabled to multiply 8 times the initial investment in less than 15 years would not have been possible if they hadn´t had an active strategy, i.e. if they had kept the asset acquired in Argentina. The investors who had a passive strategy in Argentina could obtain, in the best scenario, a profitability equal to one third of the amount obtained by those which implemented an active investment strategy.

And this is not a problem exclusively happening in Argentina. There are no guarantees. To obtain money through real estate investments, it is necessary to take into account the market cycles.

Today Argentina is facing a big challenge in terms of real estate investments. It is undergoing the Expansion phase for premium assets, so, a continued significant increase of values is not expected. Values go up only because of the constant increase in construction costs but at a slower pace, otherwise, property would reach unaffordable values. Today, the construction cost is reaching record levels of 1500USD per square meter, practically twice the amount of 3 years ago, as the cost in US dollars has risen 100%. Even so, in the same period, there has only been an average increment of 30% in values. This prevents from possible strong revaluations, unless the interest rate continues the appreciation process.

But some dynamism has been recovered because of the arrival of mortgage loans. This will enable to recreate a market whose activity level was very low because it was not possible for the middle-class people to afford a property, i.e. the market of second-hand units oriented to middle-class buyers. Furthermore, it will generate a new development offer to be constructed in peripheral zones of the city of Buenos Aires and the interior of the country. There will be a change from Palermo to La Boca district. From Belgrano to Barracas. From the Northern Area of Buenos Aires to the Western or Southern zones. This new situation will generate a very significant change for investors.

Some time ago, acquiring a property on an off-plan basis was good business and, because Argentina was experiencing a Recovery and Expansion phase within a context of strong appreciation of the peso currency, good results were obtained over time. This is something of the past and, today buying on an off-plan basis is no longer good business. Even so, the market will continue working as buyers will get credit and there will not be any investors acting as intermediaries which will be replaced by banks and end users.

In this new context, there is a huge option for investors. The best business already targeted by investment funds and family offices involves the acquisition, today, of lands suitable for residential development projects in non-premium areas of the City of Buenos Aires and Greater Buenos Aires zone and the interior of the country, to be subsequently sold or delivered to developers upon growth of demand. Locations including Metrobús stations or offering good public transport options. These are the zones where people will intend to acquire a property as prices are more convenient than in traditional areas of the city. For example: San Martin railway passage whose electrification process will soon be conducted. These zones were off developers´ radar as there was no solid target market. And this has an impact on the price. For example, a piece of land located in peripheral areas but with good potential has a current value equal to almost one quarter of the value obtained in zones such as Palermo and Belgrano. And less than half of the price in Caballito, Núñez or Urquiza.

The highest demand in these zones will create big opportunities for those having lands suitable for construction purposes.

As mortgage loans become more consolidated, demand will grow and these lands which today can be acquired at very convenient prices will experience a strong increment in their value. At INMSA, our projection for these types of lands is that they will generate approximately 45% returns within a 3-year period.

And lands with a construction capacity of 5 and 10 thousand square meters will become even more attractive. Those lands can be acquired at a lower value per square meter but as soon as the demand rises, their value will go up as developers will be benefited from the economy of scale at the time of construction.

And even when there is a latent risk of devaluation which strongly impacts the real estate business, the value of the land is usually the least affected one as the most important effect in these types of developments is in the cost of construction. In general, when there is demand and, we understand that it will grow in the next years, even with a devaluation situation, lands will be the best option to invest in.

In Argentina, only lands in the suburbs of Buenos Aires and locations away from their center in the interior of the country are the opportunity for real estate investors. Investment that can generate 50% returns in US dollar within a maximum period of 3 years. As this is a middle-class market which is still going through an expansion process, it is a unique chance.

1 Comments

I live in north Florida. I’m a real estate agent. Looking for leads from investors that are looking for an honest hard worker agent to fill their needs in investing in Florida. Any leads would be welcomed

Reply